The recent downturn in the U.S. equity markets has had a significant impact on AI-related cryptocurrencies. The emergence of DeepSeek, a cost-efficient AI model, has disrupted market expectations, causing sharp declines in several tokens. Analysts are now questioning the sustainability of current AI investment strategies.

Market Reactions to DeepSeek’s Emergence

On Monday, AI-related cryptocurrencies experienced notable price drops. This decline mirrored a broader sell-off in U.S. equities as investors reacted to the news of DeepSeek, a Chinese-based large language model. DeepSeek boasts capabilities comparable to OpenAI’s, Google’s, or Meta’s popular models but operates at a fraction of the cost.

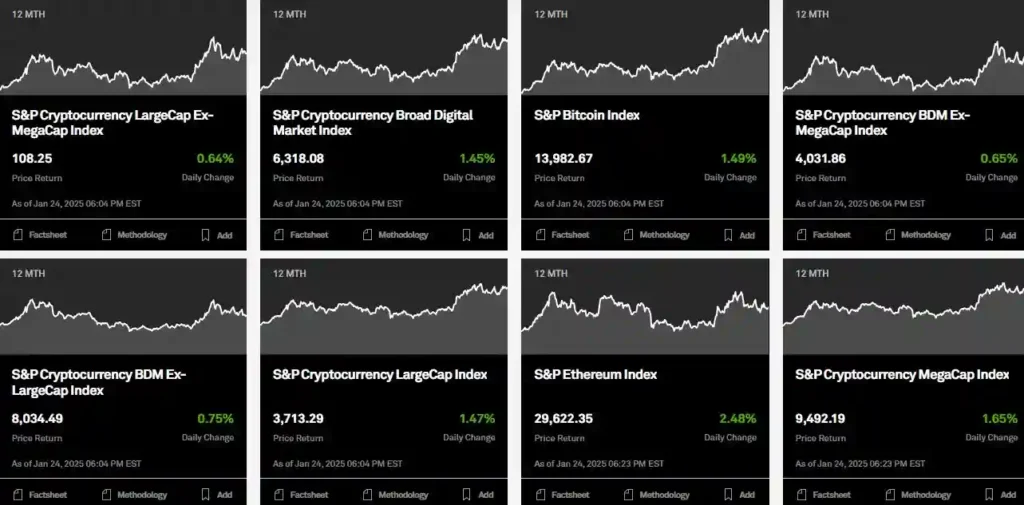

Prominent AI-related tokens, including Near Protocol (NEAR), Internet Computer (ICP), Render (RENDER), and Artificial Superintelligence Alliance, saw declines of 8%, 9%, 10%, and 11%, respectively, over the past day. This sell-off is part of broader market trends, which also saw significant drops in U.S. tech stocks.

The Dow Jones Industrial Average opened with a drop of about 369 points (0.8%). The S&P 500 fell by 2%, and the tech-heavy Nasdaq plunged by 3.6%. Notably, Nvidia stock suffered a significant downturn, falling 12% in early trading to around $124.

Disruption and Market Volatility

Despite the volatility in traditional markets, Redstone COO Marcin Kazmierczak highlighted the differences between the blockchain/crypto AI ecosystems and the stock market. “The blockchain and AI spaces are fundamentally different, with each driven by unique use cases and long-term innovation, like the upcoming collaboration between AI Agents through the CLARA framework,” Kazmierczak stated.

Bitget COO Vugar Use Zade acknowledged that technological disruptions, such as DeepSeek’s AI models, often trigger short-term market adjustments. He emphasized that these developments intersect with existing macroeconomic pressures, amplifying volatility in the crypto market.

Bitcoin’s recent dip correlates with these factors. However, history shows that tech advancements and their market impacts often stabilize as ecosystems adapt.

DeepSeek’s Efficiency Raises Concerns

DeepSeek’s emergence is noteworthy for its ability to build AI models at a fraction of the cost of established players. With pricing reportedly at just 14 cents per million input tokens—compared to $15 for OpenAI’s GPT-4 model—DeepSeek offers significant cost advantages. This efficiency has sparked concerns among investors about the sustainability of current AI investment strategies, especially as tech giants like Microsoft and Meta have committed billions to their own AI initiatives.

JPMorgan analyst Sandeep Deshpande suggested that DeepSeek’s success could mark a turning point in the AI investment cycle. Deshpande noted the substantial investments by Microsoft and Meta and highlighted DeepSeek’s lower resource-intensive model as a potential game-changer.

Analysts’ Perspectives

While DeepSeek’s efficiency is impressive, Citi analyst Atif Malik pointed out that it does not diminish the need for advanced computing hardware like GPUs. These are essential for fine-tuning and optimizing large-scale AI models.

“While DeepSeek’s achievement could be groundbreaking, we question the notion that its feats were done without advanced GPUs,” Malik stated. “What is real is that DeepSeek is charging end users significantly less, 14 cents per million input tokens, compared to $15 for OpenAI’s model.”

Conclusion

The emergence of DeepSeek has undoubtedly disrupted the AI investment landscape, leading to significant market volatility. While its cost-efficient model offers potential benefits, it also raises questions about the future of AI investments. As the market continues to adapt, investors will need to carefully consider the implications of these technological advancements.