Investing in alternative cryptocurrencies (altcoins) often comes with the allure of explosive gains, but a recent analysis paints a sobering picture of their long-term performance relative to the market leader, Bitcoin (BTC). Research conducted by Bitcoin financial services firm Swan suggests that the vast majority of altcoins systematically and rapidly lose value when measured against Bitcoin.

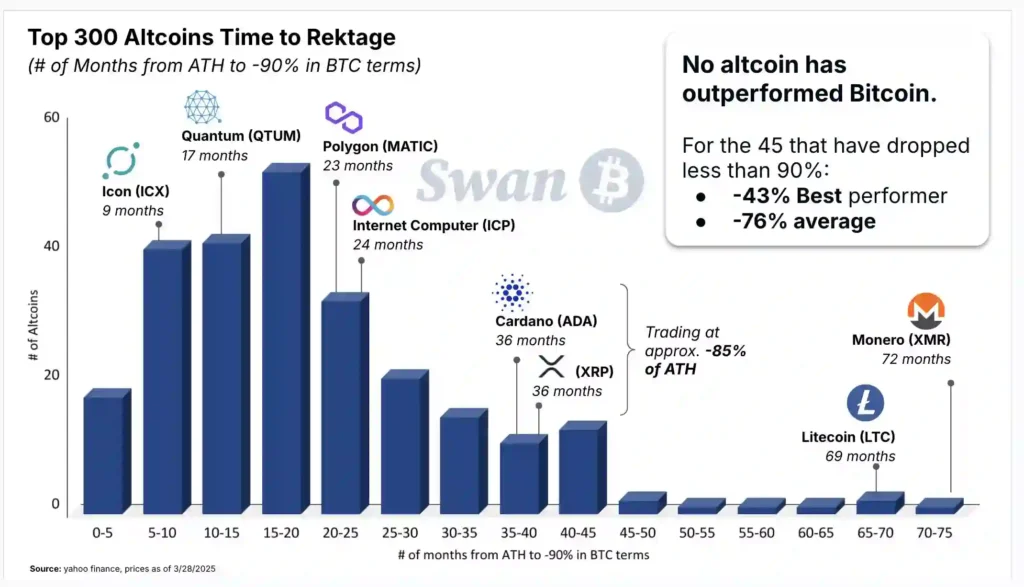

Swan’s study, detailed in April 2025, examined the performance trajectory of the top 300 altcoins over five years. The core focus was on how quickly these assets depreciated by 90% against Bitcoin after reaching their respective all-time highs (ATH). The findings were stark: the typical (median) altcoin suffered this dramatic 90% drawdown in just 10 to 20 months.

“Altcoins don’t just underperform Bitcoin. They collapse against it,” Swan stated bluntly.

The data revealed a wide range in the speed of this decline. Some tokens, like Terra (LUNA1 – referring to the original chain), Ontology Gas (ONG), and Bitgert (BRISE), collapsed extremely quickly, hitting the -90% mark relative to BTC in less than two months after their peaks. Even larger, more established altcoins weren’t spared. Cardano (ADA) and XRP (XRP), for example, took approximately three years (36 months) to reach the same -90% threshold against Bitcoin. Litecoin (LTC) saw a slower bleed over nearly six years (69 months), while Monero (XMR) exhibited the slowest decline among those studied, taking a full six years to drop 90% relative to BTC.

Swan’s analysis also looked at 45 altcoins within the top 300 that hadn’t yet hit the -90% drawdown mark. While they haven’t technically “collapsed” by this specific metric, the firm suggests they are merely delaying significant losses. On average, this group was already down 76% from their peak value compared to Bitcoin, with even the best performer in the cohort still lagging Bitcoin by 43%.

These findings strongly suggest that Bitcoin acts as a gravitational center for value within the crypto market, making sustained outperformance by altcoins exceptionally rare. Swan argues that “survivorship bias” – focusing only on the few winners that remain prominent – often obscures the widespread decay occurring across the broader altcoin landscape. “These assets don’t hedge Bitcoin — they bleed against it,” the company concluded, positioning BTC as the primary benchmark for capital preservation in the digital asset space.

The challenges for altcoins are compounded by extreme market saturation. Data indicates an overwhelming influx of new tokens, with over 1.8 million reportedly created in the past month alone. Recent reports, such as one by BeInCrypto concerning Binance listings in 2025, suggest a high failure rate, with nearly 89% of newly listed tokens trading below their initial price. This environment suggests many altcoins are driven by short-term hype cycles rather than durable fundamentals, further fragmenting liquidity and potentially undermining the prospect of a sustained “altcoin season” as Bitcoin continues to attract institutional interest and solidify its dominant position.