Asset management firm ARK Invest has significantly raised its expectations for Bitcoin’s future price, projecting a potential surge to $2.4 million per coin by 2030 in its latest bullish scenario analysis. This represents a dramatic increase from the firm’s previous $1.5 million bull case target released earlier.

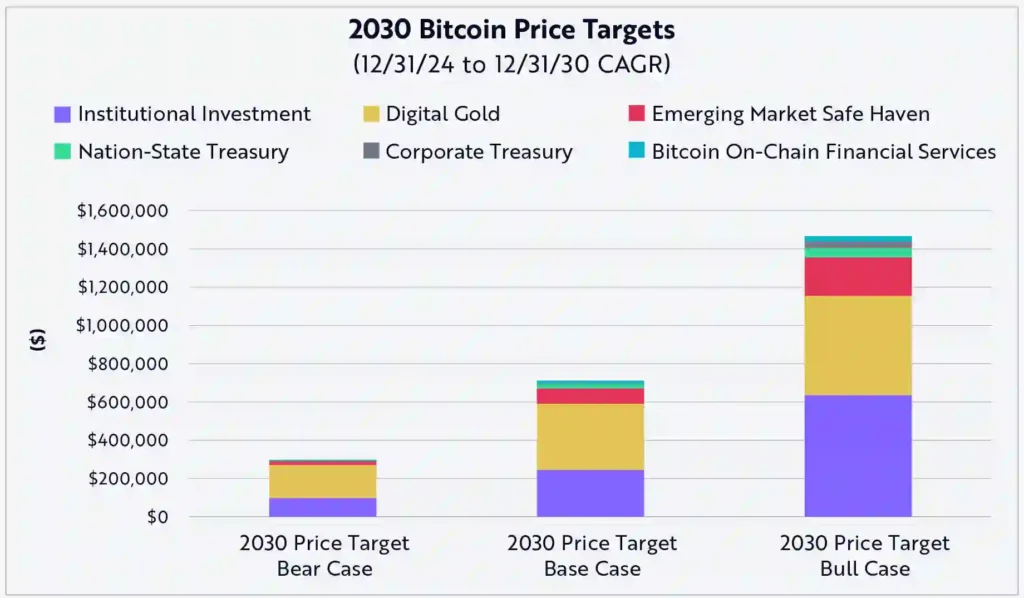

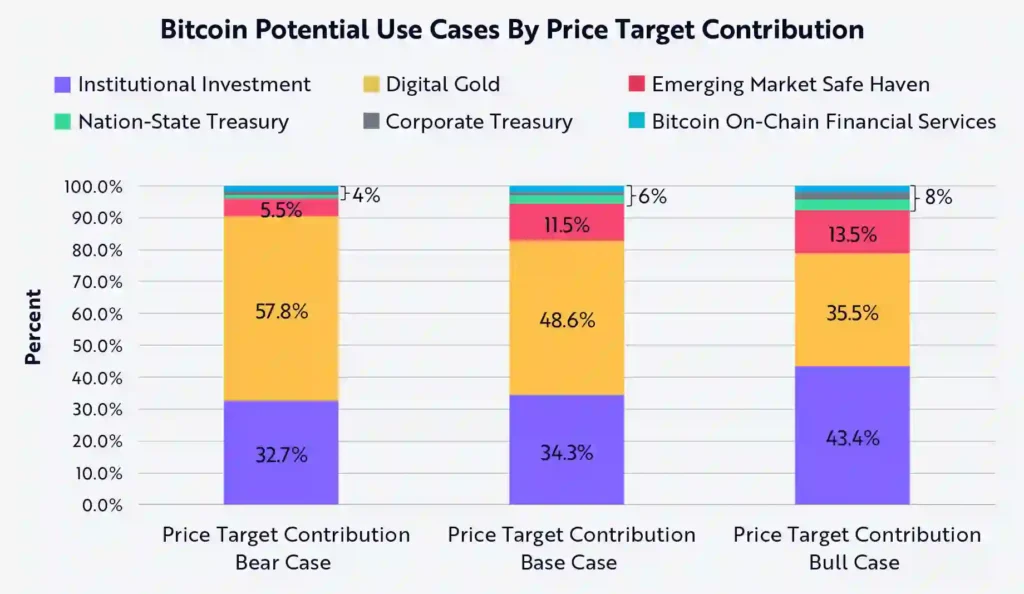

The firm’s updated outlook, current as of April 2025, suggests a compound annual growth rate (CAGR) of 72% would be needed to reach this lofty target. ARK Invest also revised its less optimistic scenarios upwards: the base case for 2030 now sits at $1.2 million (previously $710,000), implying a 53% CAGR, while the bear case was lifted to $500,000 (from $300,000), requiring a 32% CAGR.

ARK Invest attributes this heightened optimism to several potential catalysts. Key drivers include anticipated growth in institutional investments flowing into Bitcoin, its increasing recognition as “digital gold,” and its perceived role as a hedge against persistent inflation and currency devaluation globally. The analysis also considers the potential for more nations to add Bitcoin to their reserves, further corporate treasury diversification into the asset, and the expansion of Bitcoin-based financial services displacing traditional systems.

Notably, ARK’s latest modelling incorporates the concept of Bitcoin’s “active supply,” attempting to discount coins presumed lost or held dormant for long periods. According to their report, using this experimental methodology yields even more aggressive price estimates, roughly 40% higher than their main forecasts.

ARK Invest is not alone in its bullish stance. MicroStrategy founder Michael Saylor recently reiterated his view that Bitcoin could eventually surpass gold and other major asset classes, implying a price potentially exceeding $20 million per coin based on a $500 trillion market cap target discussed in March 2025. Other financial institutions and industry leaders echo this positive sentiment, albeit with varying targets and timelines. Standard Chartered projects $500,000 by 2028, while figures like Pixelmatic’s Samson Mow suggest $1 million could even be reached by the end of 2025. Investment bank H.C. Wainwright also recently increased its 2025 target to $225,000.

While these forecasts underscore a strong undercurrent of optimism surrounding Bitcoin’s long-term potential, they remain speculative. Achieving such valuations depends heavily on widespread adoption, favourable regulatory developments, and continued technological robustness, none of which are guaranteed.