The past week has been eventful for Bitcoin, with new price highs, multi-million dollar projections, and significant moves from President Donald Trump, including the release of Silk Road founder Ross Ulbricht. Here’s a detailed rundown of the key events.

New Highs and Market Movements

Bitcoin recently reached a new all-time high, with prices soaring to $108,786, just before President Trump’s inauguration. Although the price has since dipped to around $105,000, investors remain optimistic. The digital currency remains comfortably above the $100,000 mark, which is a significant psychological threshold.

Following Trump’s November election victory, Bitcoin’s value surged past $100,000. Trump promised to cut regulations and support the digital asset industry, and so far, he seems to be delivering on these promises, albeit with some discontent among hardcore Bitcoin enthusiasts.

ETF Investment Surge

Cryptocurrency investment vehicles have seen substantial inflows this week. Investors poured billions into crypto funds last week, and the trend continued with an additional $802.6 million on Tuesday alone. By week’s end, Bitcoin ETFs had amassed over $1.75 billion in assets.

This bullish trend is largely due to the expectation that Trump’s administration will be beneficial for the crypto industry. The ease of buying Bitcoin through ETFs has never been greater, making it an attractive option for investors.

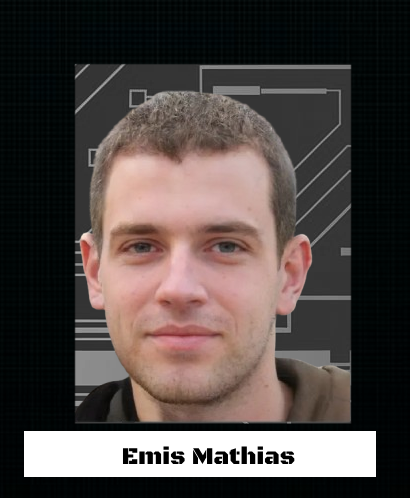

Presidential Pardon for Ross Ulbricht

In a move that resonated strongly within the crypto community, President Trump fulfilled his campaign promise by pardoning Ross Ulbricht, the founder of the Silk Road. Ulbricht, who was imprisoned in 2013 for creating a dark web marketplace primarily used for illicit transactions with Bitcoin, expressed immense gratitude upon his release. The crypto community responded by flooding his digital wallets with donations.

Ulbricht may also have a substantial fortune waiting for him. Bitcoin wallets linked to him and Silk Road reportedly hold over $47 million worth of Bitcoin. While it’s unconfirmed whether these wallets belong to him, it’s a possibility that excites many in the Bitcoin community, who view him as a pioneering figure.

Bitcoin’s Strategic Reserve: The Missing Mention

Ahead of Trump’s inauguration, there were speculations about a Bitcoin strategic reserve. However, Trump’s first crypto executive order, signed on Thursday, only mentioned the creation of a national digital asset stockpile without explicitly referring to Bitcoin.

The order stated: “The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.”

This omission has irked many Bitcoin enthusiasts, who fear it might lead to the government amassing a reserve of other digital currencies instead of Bitcoin.

MicroStrategy’s Bold Moves

MicroStrategy, a software company heavily invested in Bitcoin, received strong support from its shareholders to increase its authorized Class A common shares by 30x. This move will provide the firm with more resources to invest in Bitcoin.

MicroStrategy’s latest Bitcoin purchase brings its holdings to 461,000 Bitcoin, valued at over $48 billion. Additionally, the company announced plans to redeem over $1 billion of its existing debt, accumulated during its initial Bitcoin acquisitions.

Soaring Price Projections

Standard Chartered, a British multinational bank, issued an optimistic forecast for Bitcoin, predicting that the coin could hit $200,000 by the end of 2025 due to increasing institutional interest.

Even more ambitious predictions came from major industry players. BlackRock CEO Larry Fink suggested that widespread adoption could push Bitcoin’s price to $700,000, while Coinbase CEO Brian Armstrong envisioned a future where Bitcoin’s value could reach multiple millions.